In addition contributions are also made to Social Security Organization or PERKESOin Malay. How much is EPF contribution in Malaysia.

Epf Contribution Reduced From 12 To 10 For Three Months

Media Publications Happenings.

. Enter your PASSWORD and click Login. Ensure the correct Contribution Month before clicking Next. Ensure that the Secret Phrase is correct before entering your password 3.

Slide Slide Slide Slide Slide Slide Slide. Contribution of Epf Socso Eis Rm 20000 jobs now available in Shah Alam. EPF keep Malaysia employees salary percentage which familiar known as 11 some 7 with the new laws and regulations while employers contribute 13 of the employee salary.

Corporate Information Who we are what we do. This contribution is paid into Employee Provident Fund or KWSPin Malay. Employee contributes 0 of their monthly salary.

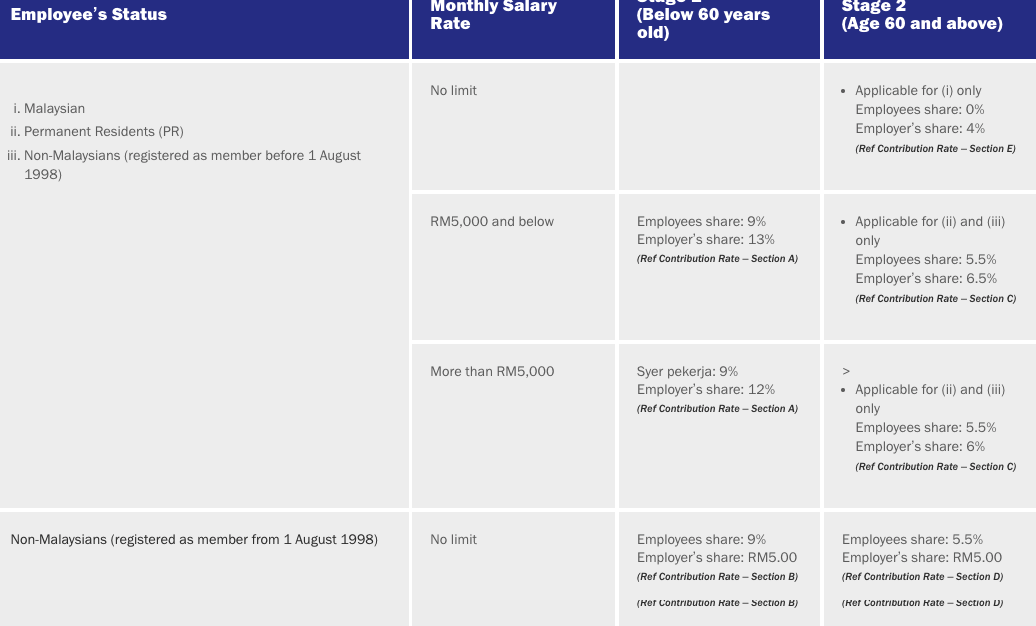

Starting from July 2022 the minimum contribution will be back at 11. Employers EPF contribution rate Employees EPF contribution rate Monthly salary rate RM5000 and below More than RM5000 RM5000 and below More than RM5000 Malaysian age 60 and above 4 0 Malaysian below age 60 13 12 9 Permanent resident below age 60 13 12 9 Permanent resident age 60 and above 65 6 55. In addition to monthly salaries Malaysian employers are also bound to contribute to the EPF EIS and SOCSO accounts of their employees.

9 of their monthly salary. The Employees Contribution Rate Reverts to 11 More Info. In this article we have summarized the facts about EPF for both the employers and employees.

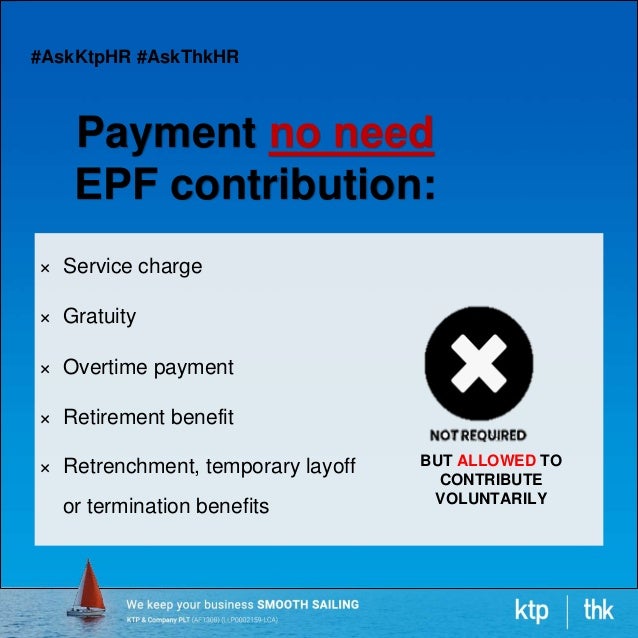

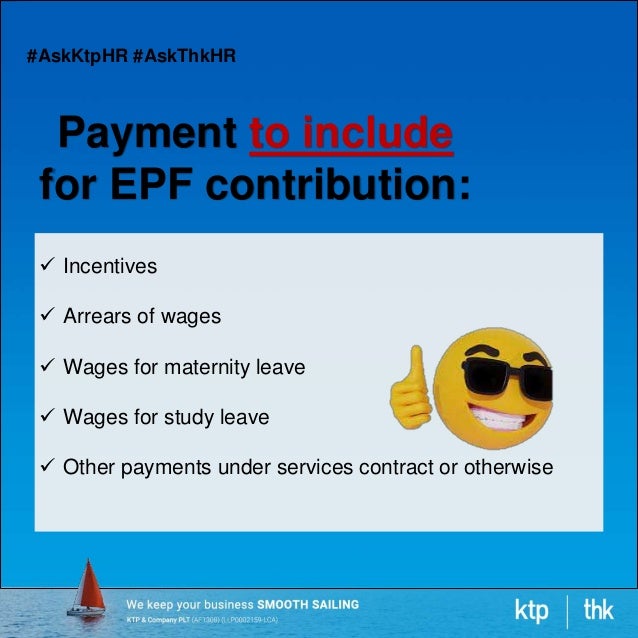

Salaries Payments for unutilized annual or medical leave Bonuses Allowances except a few see below Commissions Incentives Arrears of wages Wages for maternity leave Wages for study leave. If you opt to contribute to the EPF as a foreigner there is a caveat. Real property gains tax RPGT RPGT is charged upon gains from disposals of real property.

As an employer you are obligated to fulfil specific responsibilities including to register your organisation and employees with the EPF ensure orderly contributions and record keeping as well as comply with the existing policies and requirements. However either you or your employer or both may contribute at a rate exceeding the. Im An Employer i-Akaun LOGIN.

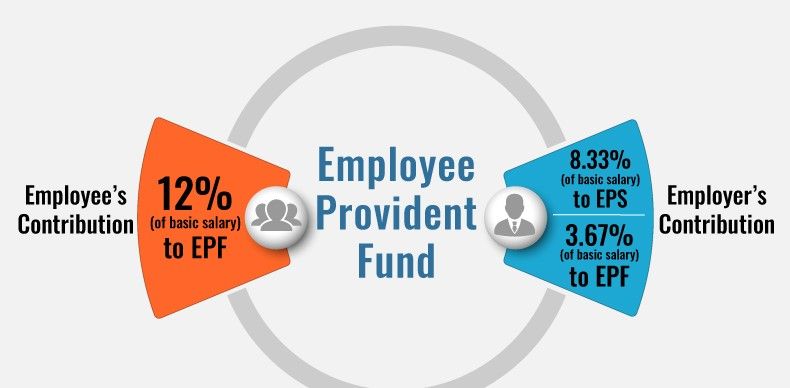

At least 534398 employers in Malaysia have contributed to EPF. When you contribute 11 of your monthly salary to the EPF your employer will contribute another 12 or 13 of your salary the statutory contribution rate is subject to changes by the government to your EPF savings. Employers are only required to make a simple monthly contribution of RM5 regardless of your monthly salary.

How to contribute to the EPF for foreign employees The first thing youll need to do is to download Form KWSP 16B and Form KWSP 3 and to fill in the relevant details. The annual EPF contribution by employer and employee sums up to RM 7841 billion as of Q4 2020. For Non-Malaysians registered as members from 1 August 1998 section B of EPF Contribution Table.

For Malaysians section E of EPF Contribution Table. I-Invest Portal Survey. EPF ENHANCES i-INVEST PORTAL WITH NEW.

Welcome to i-Akaun Employer i-Akaun Employer USER ID. On 30 June 2022 the Employees Provident Fund EPF announced that the employees contribution rate below 60 years old is now 11 effective from July 2022 s salary and contribution starts from the month of August 2022 onwards. However either you or your employer or both may contribute at a rate exceeding the statutory rates.

EPF - Employees Contribution Rate Reverts to 11. Employees aged 60 and above. When you contribute 11 of your monthly salary to the EPF your employer will contribute another 12 or 13 of your salary the statutory contribution rate is subject to changes by the government to your EPF savings.

I-Akaun Activation First Time Login. Visit i-Akaun Majikan and enter your User ID then click Next. Im A Member i-Akaun LOGIN.

The EIS covers only Malaysian citizens and permanent residents. New minimum employee EPF contribution rate starting from July 2022 From the 2022 budget the government help to increase money in the hands of the people thus the EPF reduced and extend the period of the EPF minimum contribution rate from 11 to 9 until June 2022. Both the employer and employee make monthly contributions of 02 of employees wage but restricted to a maximum of MYR 790 for employer and employee respectively.

According to the scheme the EPF contribution by employer and employee are both made available. Upon login click on Submit Contributions. Employer contributes 12 of the employees salary.

Ensure youve generated EPF CSV file from BusinessHR. Payments Subject to EPF Contribution In general all monetary payments that are meant to be wages are subject to EPF contribution. The EPF receives and manages retirement savings for all its members encompassing mandatory contributions by employees of the private and non-pensionable public sectors as well as voluntary contributions by those in the informal sector.

St Partners Plt Chartered Accountants Malaysia Epf缴纳率下调至7 的可要注意了 Reduction Of Statutory Epf Contribution Rate From 11 To 7 Employers Are Required To Use The Amendment Third Schedule As Follows For

The Complete Employer S Guide To Epf Contributions In Malaysia Althr Blog

India Payroll What Is Employee Provident Fund Epf And Employee Pension Scheme Eps How It Is Calculated In Deskera People

How To Increase Epf Contributions For An Employee And Employer In Deskera People

Confluence Mobile Community Wiki

Malaysia Keeps Epf Employee Contribution Rate Below 11 Pensions Investments

Steps To Maintain Current Employee Statutory Contribution Rate Asq

Employer Contribution Of Epf Socso And Eis In Malaysia Foundingbird

What Is Difference Between Nri And Nre Account Nri Saving And Investment Tips Savings And Investment Accounting Investment Tips

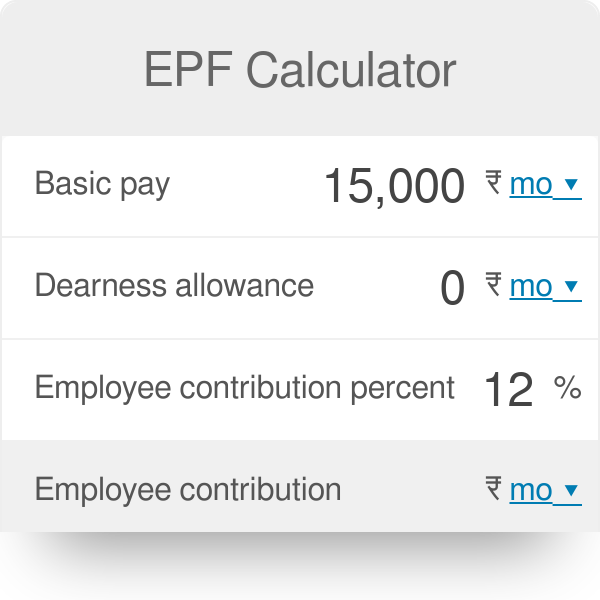

Epf Calculator Employees Provident Fund

26 Oct 2020 How To Plan Supportive Government

Epf Employer Contribution Advisory Services Employer Covid 19 Assistance Programme E Cap Yau Co

St Partners Plt Chartered Accountants Malaysia Monthly Contribution Rate Third Schedule The Latest Contribution Rate For Employees And Employers Effective April 2020 Salary Wage Can Be Referred In The Third Schedule

Employer S Contributions To Eis Epf And Socso In Malaysia Yh Tan Associates Plt